OVERVIEW INVESTMENT CRITERIA

Major Institutional investors, pension funds, and insurance companies are now investing heavily in Class A Luxury Rental Apartments that throw off stable passive income to their investments because that sector is perceived to grow substantially in the next five years. The market psychology has changed since the Great Recession. Americans are not as interested in home ownership as they were in the past, especially the young professionals and the Retired. They look for location, access to quality amenities and the freedom to change locations with minimum financial burdens.

We at Multifamily Growth Properties seek out superior locations that can offer "Country Club" like amenities at a reasonable price. We deliver high tech and efficient luxury rental apartments that use the latest technologies that our tenants can enjoy with their personal electronic gadgets. Controlling room temperatures and lighting remotely by phone app or music, games, video and television with the apartments standard smart technologies will work seamless with smart phones and iPads.

|

|

Newly developed, from the ground up, Class A apartments in the path of progress

|

|

MARKET OPPORTUNITIES AND SIZE

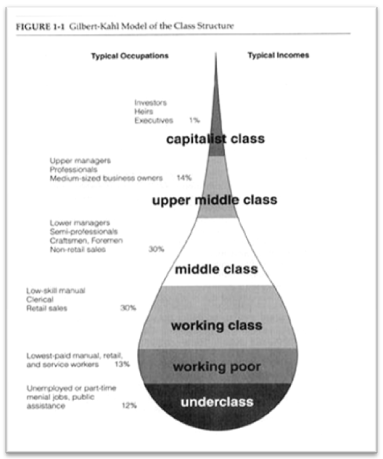

Middle Class workers are the skilled and semi-skilled workers employed in all sectors of our economy. Middle Class workers include restaurant managers, retail supervisors, construction professionals, high tech manufacturing employees, hotel management personnel, food production supervisors and health care assistants and support personnel. These are good paying jobs that are essential in keeping our economy and our country growing. From 2010 to 2020, the U.S. economy is projected to add 20.5 million new jobs as total employment grows from nearly 143.1 million to more than 163.5 million. This 14.3 percent growth reflects the assumption of a full employment economy in 2020. During this period, employment growth will be concentrated in the service-producing sector, with health care services, leisure and hospitality, transportation, and manufacturing among the fastest growing sectors. Skilled and semi-skilled occupations have the highest projected growth rate. Currently, 30 percent of the U.S. employed population is of this working middle class.

|

|

An additional 15 percent of the entire U.S. population are retired individuals living on fixed incomes. These individuals also rent in Class A and Class B rental communities. If managed properly, tenant turnover in this class can be held to a minimum and rental rates can be increased yearly using standard cost of living indices. Providing cable and Internet will also provide additional income revenues to our investors.

RENTER AND RENTAL RATES RISING

INVESTOR RETURNS

Multifamily Growth Properties pays a preferred 8 percent annual return to all investors; six percent is paid quarterly from the cash flow generated by these rental communities, and the balance of two percent accumulates and is paid either when quarterly income generated is above the six percent paid or upon the sale of the rental apartment building within a construction and stabilization period, which generally takes approximately 3-5 years. In addition, each investor will receive 50 percent of all income or profit above their 8 percent annual preferred return. At the end of the construction and stabilization process, we estimate that our investors will generate an IRR of 15 percent annually. The minimum investment amount per investor or entity is $100,000.

INSTITUTIONAL PARTICIPATION

Private equity funds, brokerage firms, and money managers can participate and charge their usual Annual Capital Management Fees and percentage of their client�s profits upon the sale of the asset.

REVENUE MODEL AND VALUE APPRECIATION

Multifamily Growth Properties will develop in high population growth markets and will target superior locations that can offer Country Club amenities. Our team of experts will create a detailed development plan and execute it with top tier contractors, construction and real estate professionals. Once the property has been fully developed and filled with quality tenants, investors can decide if to keep this income producing asset for a few more years or sell it at a better than average Capitalization Rate, creating a significant appreciation in value. Profits will then be distributed to the investors according to their investment percentages.

MARKET OPPORTUNITIES AND SIZE

Since Multifamily Growth Properties will target superior "in fill" property locations in well established communities, competition will only be with existing Class A rental apartment communities. We will know in advance what the leasing rates are in the target area, what the vacancies, if any, are and if there is an additional need for our Class A product. Competition will be held to a minimum. Multifamily Growth Properties will purchase the target property all cash and will build the first phase all cash. Once the first phase is completed and fully rented, then a permanent loan will be obtained for the first phase fully rented building's releasing funds that can be used for future phases. This Extremely conservative model will assure our investors and minimize risks!

LEADERSHIP

David Ortiz C.C.I.M. has been involved in international equity capital formation, real estate acquisitions, and commercial and residential developments for over 20 years. He has developed personally over 500 million dollars� worth of commercial and residential properties. In his impressive career, Mr. Ortiz has assembled business ventures for the acquisition of REO properties for renovation, reposition, and sale, spearheaded the real estate department of a recognized South Florida firm specializing in commercial investments for foreign high net worth individuals, and finally established his own company dedicated to developing, managing, and investing in important portfolios of residential and commercial properties for his South American clientele. A Florida native and fully bilingual in English and Spanish, Mr. Ortiz attended Florida International University and majored in Finance with a minor in International Business. He is also a Certified Commercial Investment Member (CCIM) specializing in finding "gaps" or deficiencies in growing markets.